How to do Futures Trading on Bitrue

At Bitrue, you can trade over 100 pairs of USDT perpetual futures. If you're new to futures contracts, don't worry! We've created a helpful guide to walk you through how it all works.

This article assumes you're familiar with cryptocurrency basics and focuses on introducing concepts specific to futures trading.

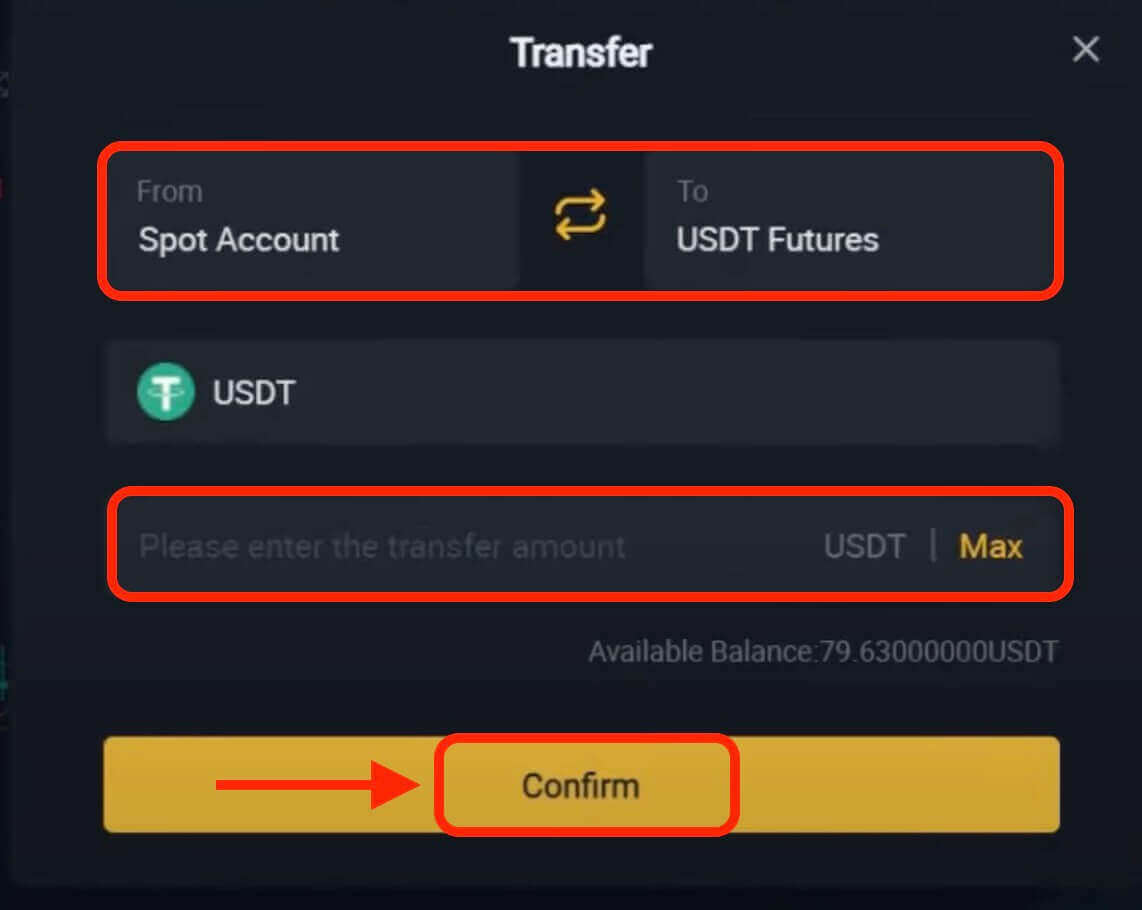

How to add Funds to Futures account on Bitrue

Before you start trading for futures you’ll need to add funds to your futures account. This separate fund determines how much you’re willing to risk and affects your trade margins. Remember, only transfer an amount you’re comfortable losing. Futures trading is riskier than regular crypto trading, so be cautious about risking your or your family’s financial stability.

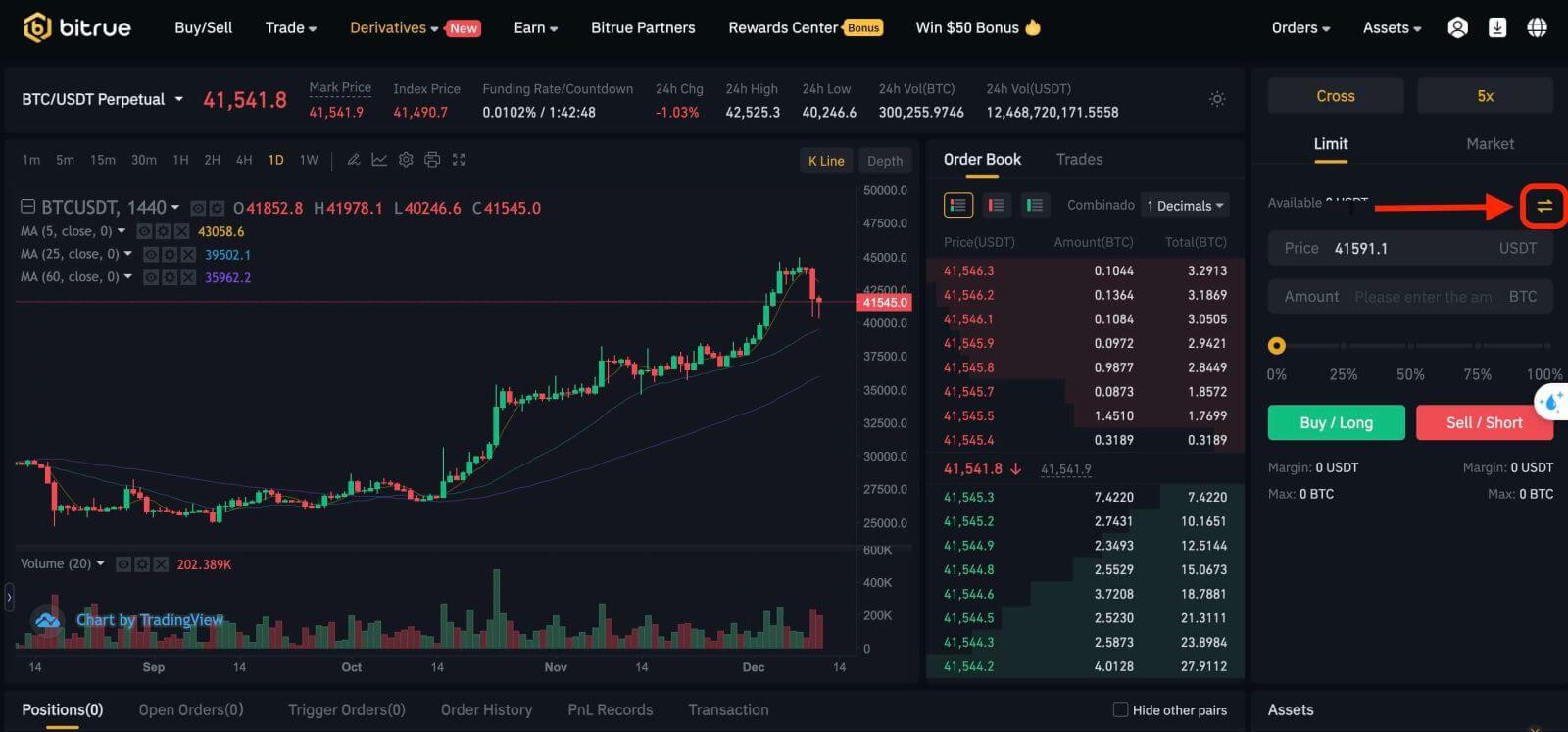

On the right side of the trading interface, look for the icon with two arrows. Click it to start funding. You can move USDT between your current and futures accounts.

Once funded, you can buy a USDT perpetual contract. Choose your coin pair (like BTC/USDT) on the top left and fill in your purchase details on the right.

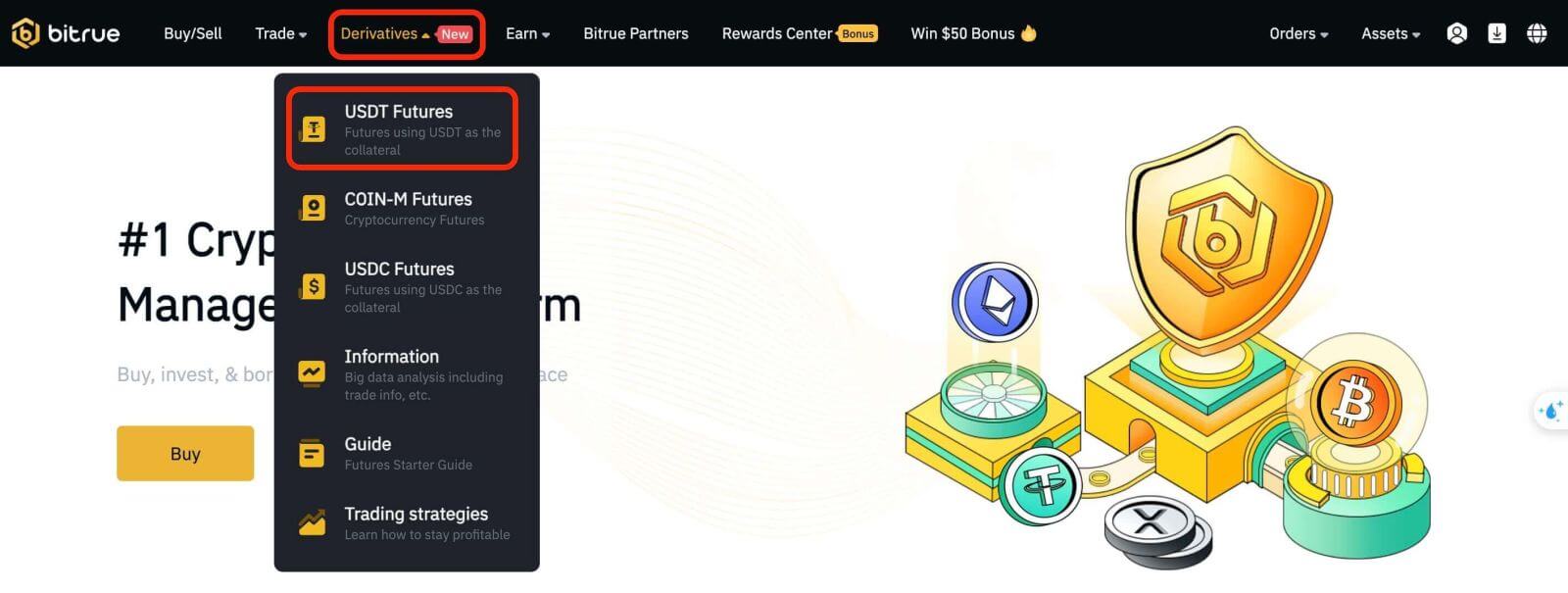

How to Open Futures Trading on Bitrue

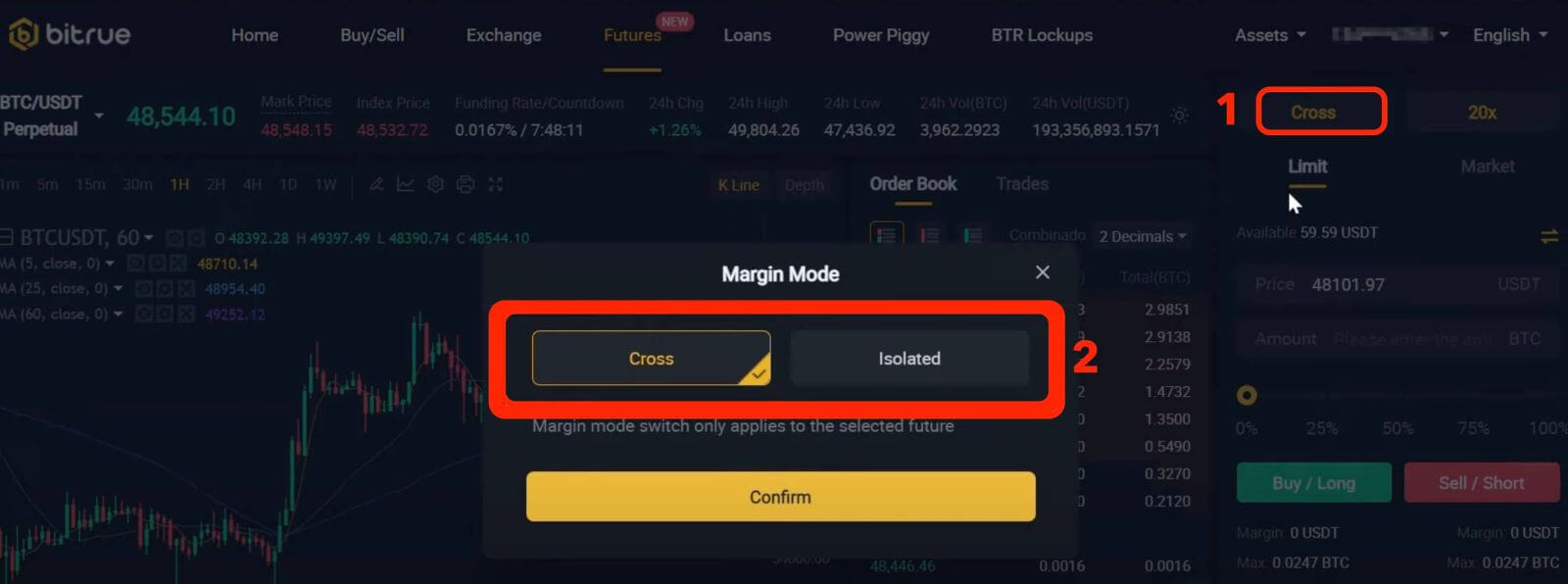

Margin Mode

Bitrue supports two different margin modes - Cross and Isolated.- Cross margin utilizes all the funds in your futures account as the margin, including any unrealized profits from other open positions.

- Isolated on the other hand will only use an initial amount specified by you as the margin.

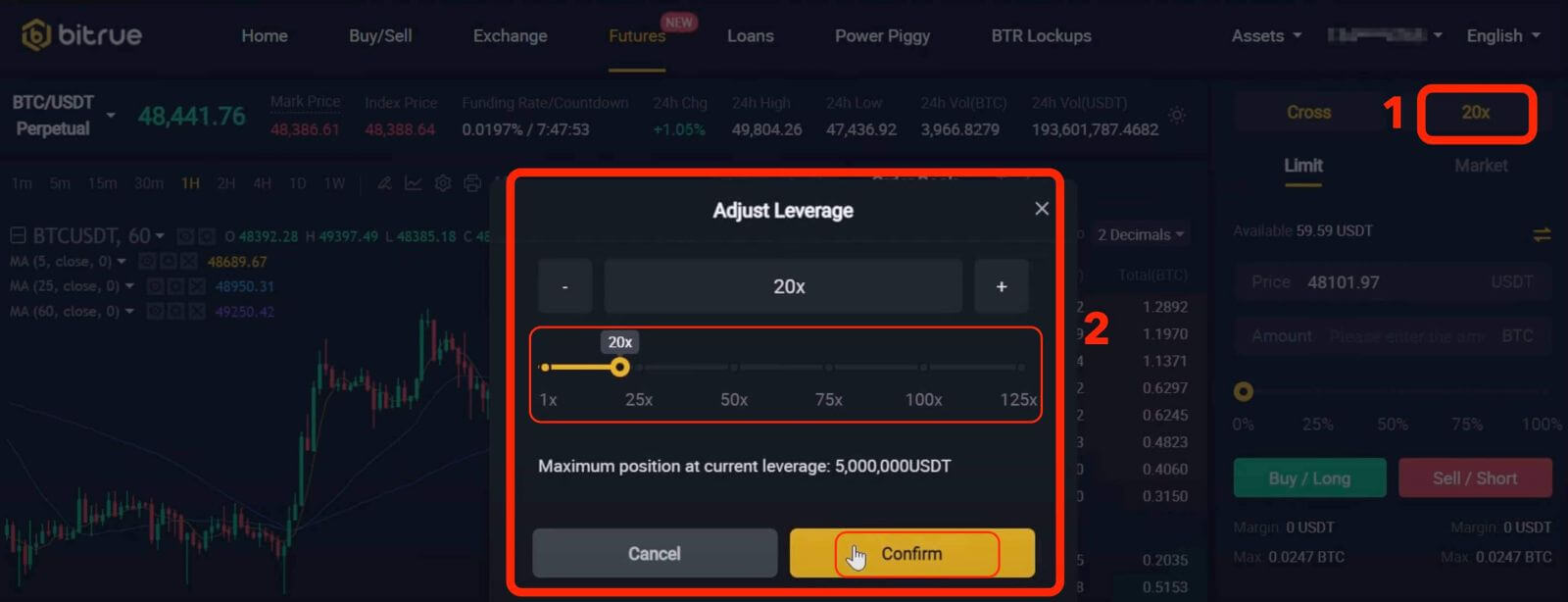

Leverage Multiple

USDT perpetual contracts allow you to multiply the profits and losses on your positions through a system known as leverage. For example, if you select a leverage multiple of 3x and the value of your underlying asset rises by $1, you will make $1 * 3 = $3. Conversely, if the underlying asset falls by $1 you will lose $3.The maximum leverage available to you will depend on the asset that you choose to purchase as well as the value of your position - to avoid significant losses, larger positions will only have access to smaller leverage multiples.

Long / Short

In perpetual contracts, unlike regular spot trading, you have the option to either go long (buy) or go short (sell).Buying long means that you believe the value of the asset that you are buying is going to rise over time, and you will profit from this rise with your leverage acting as a multiple on this profit. Conversely, you will lose money if the asset falls in value, again multiplied by the leverage.

Buying short is the opposite - you believe that the value of this asset will fall over time. You will profit when the value falls, and lose money when the value increases.

After opening your position, there are several additional new concepts to familiarize yourself with.

Some Concepts on Bitrue Futures Trading

Funding Rate

You’ll notice a Funding Rate and Countdown timer at the top of the trading interface. This mechanism ensures that contract prices stay in line with the underlying asset.When the countdown reaches 0 users with open positions will be assessed to see if they need to pay the percentage fee that is listed. If the contract price currently exceeds the underlying asset’s price, then long positions will pay the fee to short position holders. If the contract price is currently below the underlying asset’s price, then short positions will pay the fee to long position holders.

Funding fees are collected once every 8 hours at 00:00, 08:00, and 16:00 UTC. The fee is calculated using the following formula:

- Fee = Position quantity * Value * Mark price * Capital expense rate

Mark Price

Mark price is a slightly modified version of the actual price of the contract. While the mark price and the real price will generally be consistent with a very small margin of error, the mark price is more resistant to sudden changes and high volatilities, which means it is harder for abnormal or malicious events to have an effect on the price value and cause unexpected liquidations.The mark price is calculated by finding the median value from the Latest Price, the Reasonable Price, and the Moving Average Price.

- Latest Price = Median (Buy 1, Sell 1, Trade Price)

- Reasonable Price = Index price * (1 + capital rate of the previous period * (time between now and the next charge of funds / collection of funds rate interval))

- Moving Average Price = Index Price + 60-Minute Moving Average (Spread)

- Spread = The exchange’s median price - index price

Index Price

The index price represents the contract value across various market locations, including Bitrue. This method adds an extra layer of security against price manipulation, as it becomes challenging for any malicious actor to influence prices across multiple locations simultaneously.

Ladder Reduction

In the event that a position reaches an unacceptable loss as defined by the available margin, the position will not necessarily be liquidated completely, but can simply be reduced according to a tiered ladder system. This protects both the positions of individual users, as well as the overall health of the market by preventing large chain reaction liquidations.Positions will be partially liquidated to the following degrees until the margin is sufficient for the maintenance margin rate.

The related formulas are as follow:

- Initial margin = Position value / leverage

- Maintenance margin = Position value * Current tiered maintenance margin rate

Maintenance Margin Rate

This refers to the minimum margin rate required to maintain an open position. If the margin rate drops below this maintenance margin rate, Bitrue’s systems will either liquidate or reduce the position.

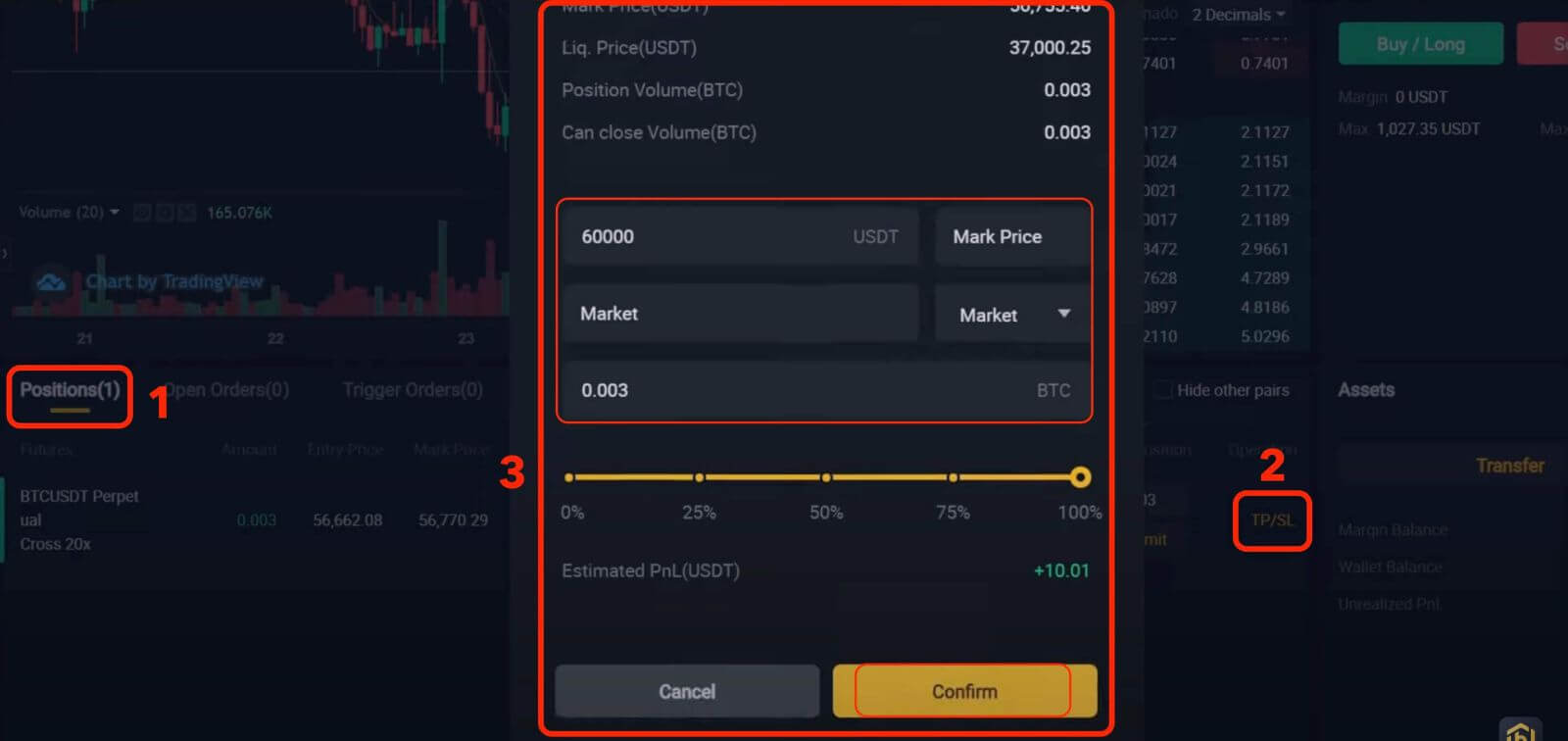

Take Profit / Stop Loss

Bitrue offers an option to set automatic price points for selling off all or part of your position once the mark price of the asset reaches a specific value. This function resembles a Trigger Order commonly used in spot trading.Once you have opened a position, look in the Positions tab at the bottom of your trading interface to find the details of all open positions. Click on the TP/SL button on the right to open a window where you can enter the details of your order.

Enter the trigger price in the first field - when the mark price of the asset hits the value that you enter here your order will be submitted. You can choose to sell your asset using either limit or market trades. You can also choose to specify how much of your holdings you wish to sell off in the order.

For example:

If you have a long position in BTC/USDT and the opening price is 25,000 USDT,

- If you set a stop-limit order with a trigger price of 30,000 USDT, the system will automatically close the position for you when the marker price reaches 30,000 USDT.

- If you set a stop-loss order with a trigger price of 20,000 USDT, the system will automatically close your position when the marked price reaches 20,000 USDT.